How To Dispute A Medical Bill Domain_10

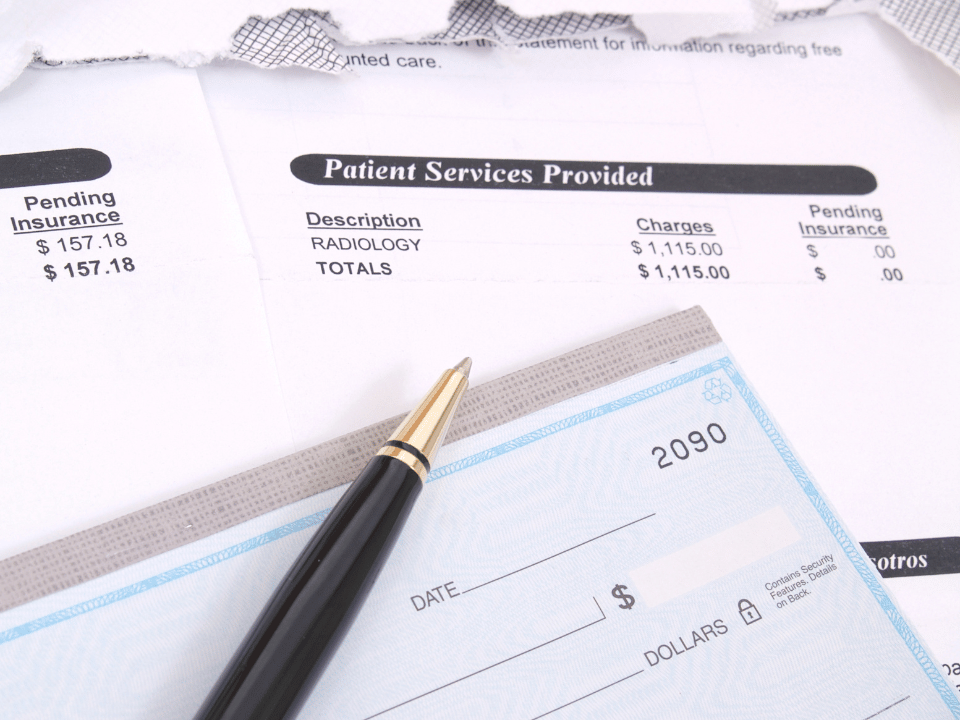

Whether expected or unexpected, medical bills tin easily impact financial plans. Medical bills are often confusing, complicated, and oftentimes higher than expected.

Yous may not exist aware that medical bills aren't final and may exist disputed. If you think the bill is too loftier, has erroneous or hidden charges, you can file a dispute with your medical provider. If you want to dispute a medical pecker, you lot've come to the right place. Medical billing advocates can work on your behalf to brand sense of your medical bills and help negotiate.

What is a Medical Billing Dispute?

Simply put, a medical billing dispute is when a person disagrees with what they are charged for a medical service or process. Some of the more than common reasons that yous may exist overcharged or don't agree with your beak may be due to homo error or surprise medical bills. Surprise bills oft result from getting emergency treatment or care from someone outside your insurance network. When this happens, the bills are often much college and unexpected than what you would get charged under normal circumstances.

Since the enactment of the No Surprises Human activity of 2022 there's now federal laws that protect people against surprise billing. As a consequence, there are fewer disputes related to surprise bills. Notwithstanding, whether your medical bill comes as a surprise or not, yous accept the right to dispute information technology.

No Surprises Act

The "No Surprises Deed" went into event on Jan 1, 2022. This act helps to protect patients from surprisingly loftier medical bills for the services they receive. If y'all're insured through your employer, a Marketplace Programme or an individual health plan this law:

– Bans surprise bills for virtually emergency services, fifty-fifty if you become them out-of-network and without approval beforehand (prior dominance).

– Bans out-of-network price-sharing (similar out-of-network coinsurance or copayments) for most emergency and some not-emergency services. You lot can't be charged more than in-network cost-sharing for these services.

– Bans out-of-network charges and balance bills for sure additional services (like anesthesiology or radiology) furnished by out-of-network providers as part of a patient's visit to an in-network facility.

– Requires that healthcare providers and facilities give you an piece of cake-to-understand notice explaining the applicable billing protections, who to contact if y'all have concerns that a provider or facility has violated the protections, and that patient consent is required to waive billing protections (i.e., you must receive detect of and consent to being balance billed by an out-of-network provider).

If you're uninsured or make up one's mind to self-pay, this law and then requires you to be provided with a "good faith" estimate of how much your care will price Before you become care.

When patients receive a bill that is significantly different from their estimate, there are specific options they have to assist remedy the situation. Of grade, navigating these laws tin exist hard for many patients, but at that place is legal recourse to help. However, do not forget that the Emergency Medical Treatment and Active Labor Act (EMTALA) ensures that you are provided with a medical screening exam (MSE) and stabilization if you lot have an emergency medical condition at Emergency Department's without consideration of your power to pay or possible costs.

What to Consider Before Challenging Medical Bills

There are several critical factors that patients should consider earlier starting downwardly the route of a challenge to their medical bills. Spending some fourth dimension to empathize those considerations before you starting time the process can lead to better outcomes, and a much smoother overall process.

Know Your Eligibility for Dispute Resolution

If you're considering using the dispute resolution process set up out past the No Surprises Human action, there are some qualifying criteria that will allow you to use this process. Those criteria include:

- You lot didn't employ your insurance to pay for the procedure (You lot were either uninsured or had insurance, just didn't employ it for the procedure or service).

- Your care occurred on or subsequently January i, 2022.

- Your provider gave yous a good organized religion estimate

- Your most recent pecker is from the last 4 months (120 calendar days).

- The deviation between the judge and final bill from any provider or facility is at least $400.

Understand Your Explanation of Benefits (EOB)

Your explanation of benefits is a alphabetic character or argument provided by your insurance company that goes through dissimilar factors of your care. This includes what the insurance was charged for the procedure, what the insurance company paid, and what amount you are responsible for paying to the provider or facility.

The explanation of benefits is not a nib. The bodily bill will come up from the facility or individual provider. It is of import to keep your EOBs to ensure that what y'all're billed from the provider matches what was paid by the insurance company.

eight Steps on How to Dispute High-Price Medical Bills

Now that you lot know that all medical bills are open up to dispute allow's await at how to follow through with the process.

1. Gather Information on Your Medical Bills

One of the offset reasons that individuals await into challenging a medical beak is considering their beginning reaction to the cost of the bill is that it is outrageous. There are a variety of tools online that allow individuals to go cost comparisons near their medical care. This includes tools from FAIR Health, and the Healthcare Bluebook to give y'all an estimate of what is typical in your location.

2. Request an Itemized Bill and Review for Errors

You should first get an itemized bill showing a complete listing of services and treatments for which you're getting charged. In one case you have the itemized list, you can check for errors such as:

- Indistinguishable or repeat charges

- Illegal surprise charges

- Billing errors

- Incorrect treatments

- Hidden fees

In improver to being astronomically high, medical bills often demand to be antiseptic and made easier to read. By getting an itemized list, you tin double-bank check that you're getting charged for the correct handling(s) or procedure(s).

3. Talk to Your Provider'due south Medical Billing Department

Once you understand your medical bill, y'all know what you're negotiating. The information allows y'all to contact your medical provider and enquire them for a lower rate or discounted medical pecker. While you lot can enquire them for discounts under any circumstances, y'all'll have a improve chance of getting them if you prove you lot're overpaying. Additionally, if you feel at that place is a fault in your neb, yous can have your provider explicate those costs. You can also request a review so they can prepare whatsoever mistakes.

four. Get in Contact With Your Insurer

If you are still negotiating with your medical provider, your next stop should be your insurance company. In addition to an itemized listing of services from your medical provider, you should also receive a list and explanation of benefits from your insurance provider. Upon reviewing your listing of benefits, you lot'll accept a amend idea of what your insurance company will and volition non pay.

If you don't remember they're paying for everything they're supposed to, you can file an appeal with them. You can too file an appeal if they aren't reimbursing y'all for out-of-pocket expenses incurred during treatment. Typically, y'all'll only accept upwardly to 6 months to file an entreatment.

five. File an Entreatment with Your Insurance Visitor

You can contact your insurance company if you experience that there is an fault in the bill, or if you feel that the provider isn't following the No Surprises Deed. Additionally, Centers for Medicare and Medicaid Services (CMS) has a dedicated hotline that is open up seven days a calendar week to field questions and complaints, the No Surprises Assist Desk-bound (ane-800-985-3059).

vi. Push button Back Against Coercive Credit Reporting

Depending on who your medical provider is, they may have outsourced your medical bill to a collection agency. When this happens, you must file an appeal with the collection bureau and explain the situation to them. Typically, your bill will only get transferred if some amount of fourth dimension has passed after you were billed and you have non reached out to the provider.

Kindly explain to the drove agency that you're disputing the neb and see if they will await to collect it or get the courtroom involved until the dispute gets resolved.

Debt collectors cannot report a medical bill to the credit reporting bureaus without first trying to collect the debt from you. Typically, debt collectors just hope that you lot'll pay the nib without question, just yous have the right to dispute the information. Furthermore, debt collectors are spring by the Off-white Debt Collection Practices Act and you may desire to research your applicable rights nether the law.

7. Get Help from Your Patient Advocate

In about parts of the country, hospitals and medical facilities have patient advocates bachelor upon request. Patient advocates get employed by the medical facility to act on behalf of the patients they're treating. They can assistance you with insurance appeals and information, filing a dispute with the medical provider, and helping every bit you review your pecker and listing of benefits.

8. Enlist the Services of a Medical Billing Abet

While patient advocates are a big help, they are often spread thin throughout the hospital and sometimes demand to dedicate more than fourth dimension and energy to your case. When this happens, the best way to dispute a medical nib is with the help of a medical billing advocate. Medical billing advocates are wellness care advocates with intimate knowledge of the medical billing system and billing codes.

Hither are some ways a medical billing advocate can aid you lot dispute a medical beak.

- Spot errors with your medical beak much quicker and easier than yous would.

- Negotiate on your behalf with your medical provider to become a discounted nib.

- Negotiate with your insurance company to ensure they're paying for everything they're supposed to.

- Assistance you understand confusing medical bills.

- Help you codify a plan of assault when you dispute your medical bill.

- Assist you as you prepare a repayment plan that fits your budget.

Medical billing advocates likewise have a better knowledge of medical billing and revenue codes than patient advocates. Our sole job revolves around ensuring a medical bill is discounted and holding your medical provider and insurance companies answerable. While many people plough to medical billing advocates every bit a last resort, you lot should contact us immediately if you want to dispute a medical bill because time is of the essence.

Oft Asked Questions

Source: https://www.amazinghealthcareconsultants.com/how-to-dispute-a-medical-bill/

0 Response to "How To Dispute A Medical Bill Domain_10"

Post a Comment